India’s food processing industry is undergoing a remarkable transformation. According to a joint study by Deloitte and FICCI cited in The Economic Times, the sector currently supports over seven million jobs and contributes around 7.7% of the total manufacturing Gross Value Added (GVA) in the country.

Valued at $160 billion, the industry is not just a critical employment generator but also a strategic pillar for rural development, agri-export potential, and consumer wellness. But what’s fueling this growth—and what still holds it back?

🔍 Key Drivers of Growth

- Rising Rural Demand

Rural India now contributes to over 45% of total FMCG sales, according to NielsenIQ. Improved incomes, electrification, mobile penetration, and digital literacy have empowered rural consumers to seek branded, processed, and value-added food products. - Digital Transformation

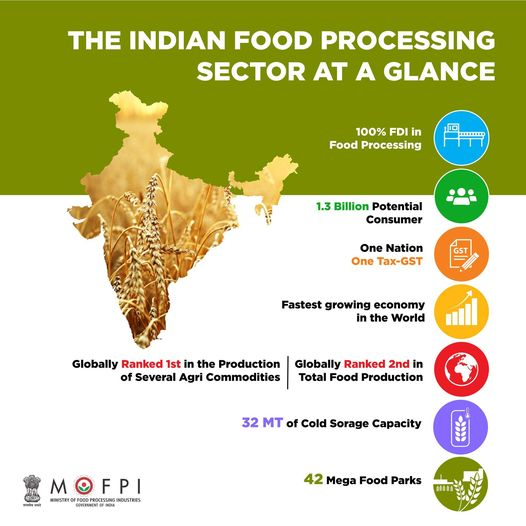

From AI-driven quality checks to blockchain-based traceability and IoT-enabled cold chains, technology is bridging the gap between farms and forks. India now hosts over 1,000 agri-tech startups, and investments in food-tech are growing at a CAGR of over 25%. - Policy Support & Reforms

The Production Linked Incentive (PLI) Scheme for Food Processing has earmarked ₹10,900 crore ($1.3 billion) to incentivize the growth of globally competitive Indian food brands. Additionally, the Agriculture Infrastructure Fund and PM Formalisation of Micro Food Processing Enterprises (PMFME) scheme are creating a robust support ecosystem. - Health-Conscious Consumption

The Indian nutraceutical and health food market is expected to reach $18 billion by 2025. With rising awareness, consumers are actively seeking protein-rich, plant-based, and organic alternatives. This is reshaping product development priorities for processors.

🚧 Challenges Still Loom Large

Despite the positive momentum, inefficiencies in the supply chain remain a major roadblock:

- Nearly 30% of fruits and vegetables produced in India perish before reaching the market due to a lack of adequate cold storage and processing.

- Fragmented logistics and underdeveloped rural road networks increase operational costs by 20-30% for food processors.

🧭 The Way Forward: Strategic Imperatives

To capitalize on this pivotal moment, industry stakeholders must act decisively:

✅ Invest in Smart Infrastructure

- Cold chains, food parks, and last-mile delivery must be integrated with IoT and AI-driven inventory and temperature management systems.

✅ Diversify Product Portfolios

- Functional foods, fortified staples, and ready-to-eat meals catering to urban, health-conscious consumers can unlock new revenue streams.

✅ Focus on Sustainability

- Eco-friendly packaging, zero-waste processing, and solar-powered operations are becoming industry imperatives—not just good-to-haves.

✅ Strengthen Global Outreach

- India exported $6.27 billion worth of processed food in FY23, led by marine products, processed fruits and vegetables, and cereals. There’s vast untapped potential in markets like Africa, Southeast Asia, and the Middle East.

🔊 Final Thought

“India’s agri and food processing sector is on the brink of a transformative leap, where tradition meets cutting-edge technology to build a future-ready food ecosystem.”

– Anand Ramanathan, Partner, Deloitte South Asia

The future of food in India lies in collaboration across technology, agriculture, and innovation. It’s time for exporters, processors, and policymakers to work together to make India not just the kitchen of the world, but its most resilient and responsible one.

📩 Interested in exporting premium agri-based products or tapping into India’s food processing ecosystem? Let’s connect and explore potential synergies.

#FoodProcessing #AgriExports #MakeInIndia #DigitalAgri #SupplyChain #IndianAgriculture #FMCG #HealthyEating #ExportFromIndia #ShreeShubhamExim